Don't Miss

- 4 Unexpected Things I’ve Learned From Buying My First Mobile Home Park

- How Ironic: America’s Rent-Controlled Cities Are Its Least Affordable

- U.S. homes are still a bargain on the international market

- Getting The Best Possible Quality Photos On MLSs and Syndicated Sites

- Home buyers in these markets have the upper hand

How Much Can I Contribute To My Self-Employed 401(k) Plan?

By reinvestor on February 19, 2016

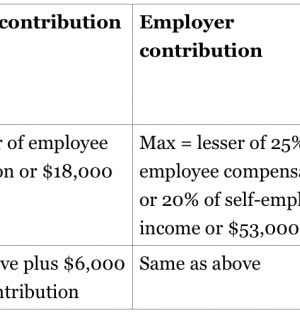

The IRS says you can contribute up to $53,000 in your tax-deferred Self-Employed 401(k) for 2016. If you’re at least age 50, then you can make an additional $6,000 catch-up contribution, which increases your limit to $59,000. That’s $18,000 or $24,000 (age 50+) for the employee contribution and up to $35,000 for the employer contribution for a total contribution of $53,000 or $59,000 (age 50+).

100% Secure

100% Secure

You must be logged in to post a comment Login